Primary Market System for the Exchange

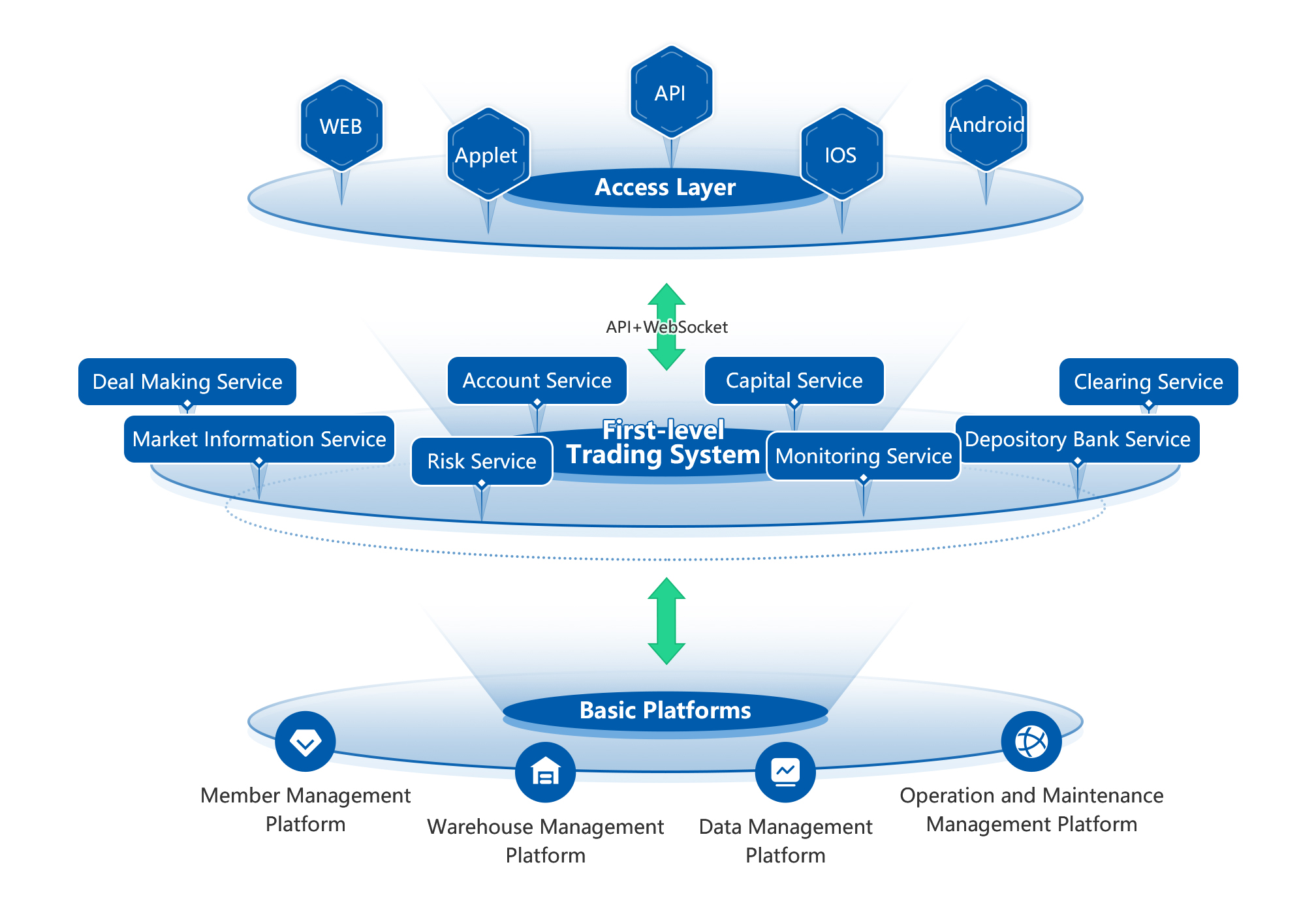

The Primary Market System for the Exchange is a spot trading market with a unified structure, which supports a variety of trading rules such as bidding, pricing, and trade by agreement. The system also supports diversified trading, and has perfect market information services, with which market participants can flexibly expand services.

The Primary Market System for the Exchange provides customers with integrated trading services and diversified business types, supports spot trading and extended trading, as well as the Shanghai-Hong Kong Stock Connect, connecting to ETF and other non- trading business platforms. It provides efficient market information, with short fail-over time and short delay, and is easy to expand. Its performance and capacity are easy to expand, and flexibly supports new products and new services.

The main functions of the Gold Secondary Market Trading System include trading management, clearing management, delivery management, customer management, institution management, risk control, system monitoring and so on.

It supports all types of trading that the exchange allows for corporates, individuals and dealers and provides with agency mode; flexible distribution of commission; the key nodes use multiple services to run tasks in parallel to effectively avoid the risk of single point of failure and improve the system availability. Both the system access and trading processing use multiple services to run tasks in parallel, and the number of concurrent users and the concurrent volume are increased. From the communication layer to the business processing layer, different security designs are adopted at different levels to meet the requirements of being autonomous and controllable in the national strategic information innovation transformation, and to support the operation of a variety of databases and operating systems made in China.