Commercial Bank Payment

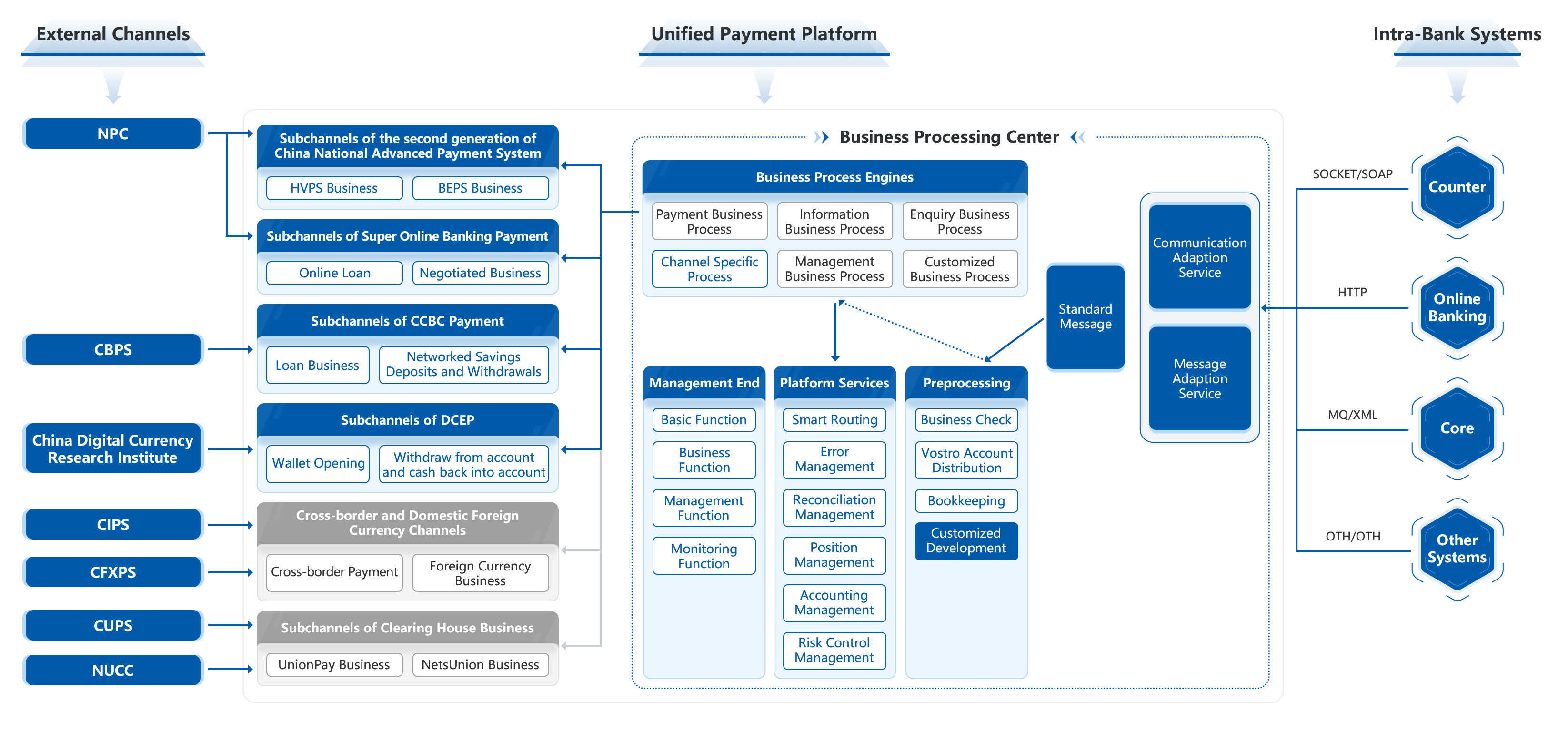

The Commercial Bank Payment System is the financial infrastructure for commercial banks to meet customers’ needs for remittance and transfer. Our unified payment platform, as a centralized processing hub for inter-bank payment integrating and managing multi-payment channels of banks, takes the payment platform as the core, connects front-end individual and corporate payment scenarios through users and bank accounts, and provides multi-channel, multi-currency and multi-mode inter-bank payment, clearing and settlement services.

Features and advantages

- Multi-channel and Multi-currency: The platform supports access to multiple payment channels such as the second generation of China National Advanced Payment System, super online banking, Cross-border Interbank Payment System, FXCC, CCBC, rural credit banks payment and clearing system, UnionPay, NetsUnion, ACS, and universal financial information transmission, and supports multi-currency payment trading, thus meets the comprehensive requirements of inter-bank payment business;

- Standard Access: It shields the differences in communication methods and data structures of various payment channels, provides banks with unified standard communication access methods, business processing interfaces and data configuration, and reduces the impact of changes in peripheral channels on banks' core and business systems;

- Payment Business Integration: The platform’s business undertakingintegration function provides a unified business model, which enables payment businesses of different channels to share a set of processing processes within the platform, thus helps banks and their customers focus on business and improves user experience;

- Internal and External Collaboration: Based on the integration and management of all payment business channels of the bank, a centralized processing hub for inter-bank payment is built to connect bank users and enterprises through account scenarios internally, and connect regulators at all levels externally;

- Excellent Performance: The Spring Cloud distributed microservice architecture is adopted, which has high availability and scalability and can meet the long-term business growth needs of banks;

- Efficient Management: The platform integrates the communication/message protocols, business processing processes,andoperation and maintenance methods of all channels in the payment chain to achieve intelligent routing of inter-bank payment, unified reconciliation and error handling;

- Information Innovation Adapter: It completes mutual recognition of information innovation adaptation with the domestic mainstream operating systems, databases, application middleware, and communication middleware.