Build a "mutual trust bridge" to achieve interconnectivity and connectivity of financial and credit services for banks in Macau!

The Outline of the Development Plan for the Guangdong Hong Kong Macao Greater Bay Area proposes that Macao should promote moderate and diversified economic development, among which the modern financial industry is one of the four key industrial sectors for development. Under this guidance, the banking industry in Macau has made positive progress in diversified services, asset size, financial regulation, and other aspects. Financial cooperation with mainland China and Hong Kong has become increasingly close, and credit business has shown strong growth momentum.

In the process of financial business development, the drawbacks of personal credit data being unable to be shared among commercial banks have gradually been exposed, posing risks and hidden dangers to the long-term development of Macau's financial business. To this end, the credit management department of the Macau government led the construction of the Macau Credit Information Platform System (PDC), becoming the only personal credit platform in Macau. Yanlian Computing, a subsidiary of Yinyan Technology Service Group, is rooted in the Guangdong Hong Kong Macao Greater Bay Area and has become the only contractor for the central end of the platform with years of project experience in payment and transaction fields. At present, the system has been running smoothly for over a year, achieving inter bank credit information exchange and sharing, and improving the level of credit services in Macau.

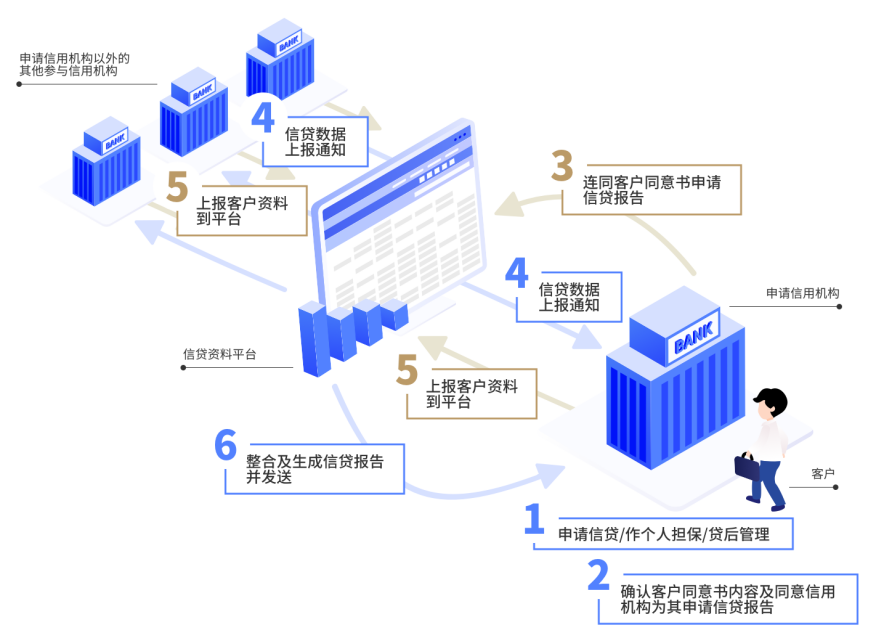

The Macau Credit Information Platform consists of a credit reporting system deployed at the central end of the credit management department and a front-end system deployed at the commercial bank end. Provide the following services:

Provide a secure transmission platform for personal credit information of participating banks

Provide data integration for personal credit information of participating banks

Provide personal credit report query services for participating banks

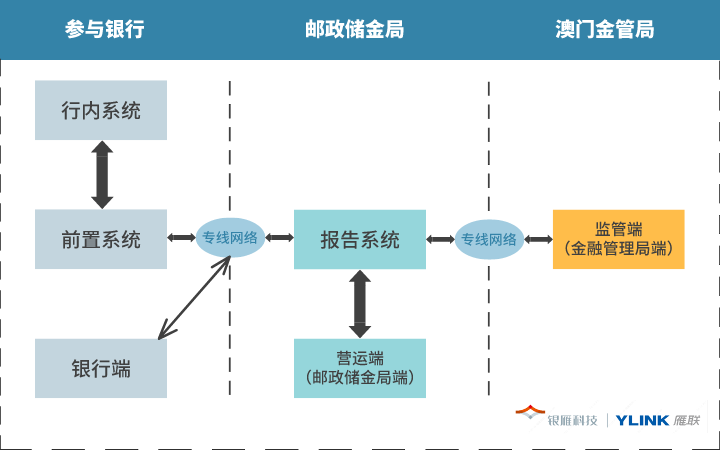

The PDC center produces a credit report within a certain period of time based on the application submitted by the bank. The credit report integrates the credit information of a certain individual customer in all banks in Macau for reference when the applying bank approves the loan application. The message transmission between the central end and the bank adopts dedicated line connection, and the transmitted business messages are encrypted and signed with electronic certificates, effectively ensuring the security of customer data information.

The PDC front-end system is a bridge between the bank's internal system and the central reporting system, adapting to the differences between the interfaces of the bank's internal system and reporting system. It processes the data or files transmitted by the internal system, interacts with the central end according to the communication specifications and message formats provided by the central end, and effectively controls security risks while processing business.

Since the launch of the Credit Data Platform (PDC) system, while effectively ensuring the security of personal data, it has improved the bank approval process and reduced the cost of pre loan review, increased lending speed, and reduced the risk of excessive financing for local residents in Macau. Moreover, the platform also stood out from over 500 cases in 2023 and was awarded the "Jinxintong" Financial Technology Innovation Application Case by the China Academy of Information and Communications Technology in the third edition!

In the future, Yinyan Technology will continue to leverage its advantages to promote the further development of banking business in Macau, actively participate in the construction of financial infrastructure, reduce the risks and costs of the operation of the Greater Bay Area financial system, promote the integration and development of the Greater Bay Area, and contribute to the economic prosperity and social stability of Macau and the Greater Bay Area.